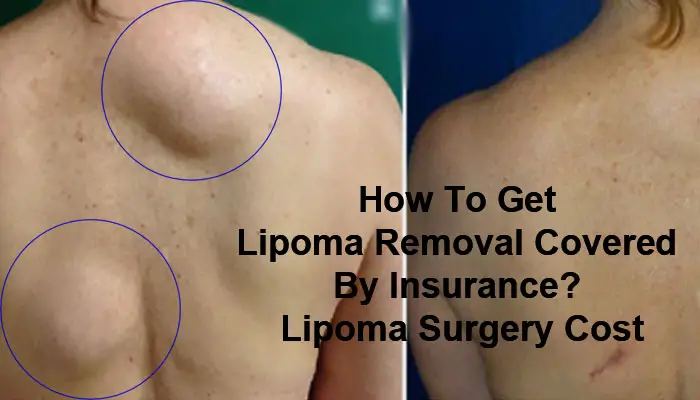

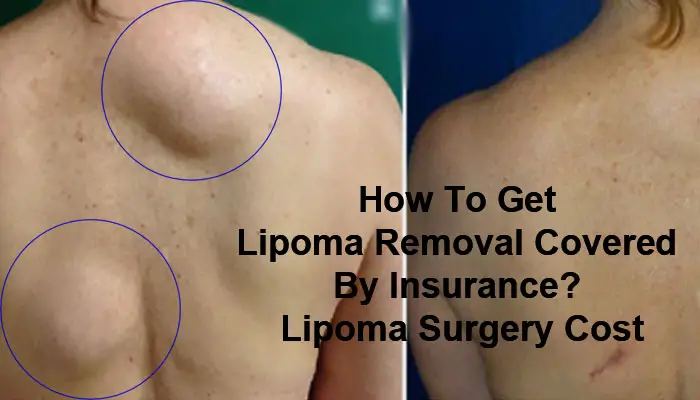

How To Get Lipoma Removal Covered By Insurance? Lipoma Surgery Cost

- By Infoik

- 24 Feb, 2022

How To Get Lipoma Removal Covered By Insurance?

If you have a lipoma, you may be wondering if it is covered by insurance or not. Unfortunately, lipoma removal is not typically a covered procedure by insurance companies. However, there are ways that you can get the procedure covered. In this article, we will discuss how to get lipoma removal covered by insurance and what your options are. Keep reading for more information!

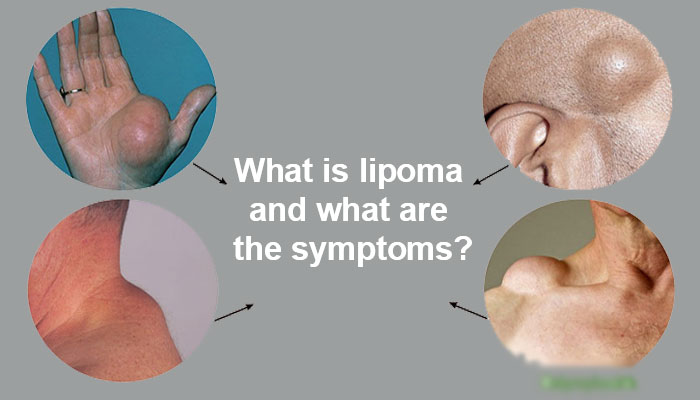

What is lipoma and what are the symptoms?

A lipoma is a benign tumor that is made up of fatty tissue. It is usually located just below the skin and feels like a soft, rubbery lump, soft tissue tumor. Lipomas are typically small, but they can grow larger over time. Some common symptoms of lipomas include:

– A soft, rubbery lump just below the skin

– No pain or discomfort

– Slow growth over time

If you are experiencing any of these symptoms, it is important to see a doctor. Lipomas are not typically harmful, but they can sometimes cause problems if they grow too large.

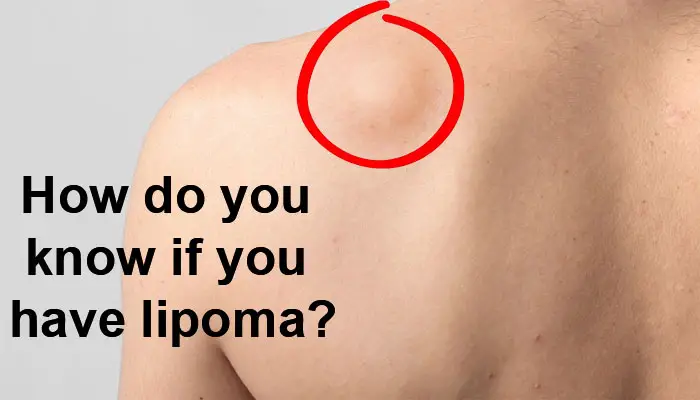

How do you know if you have lipoma?

If you are wondering if you have a lipoma, there are a few things to look for. Lipomas are typically small and soft, so they are easy to miss. Here are some tips for spotting a lipoma:

– Look for a soft, rubbery lump just below the skin

– Check for lumps near the joints, as lipomas often form in these areas

– See a doctor if you are experiencing any other symptoms, such as pain or discomfort.

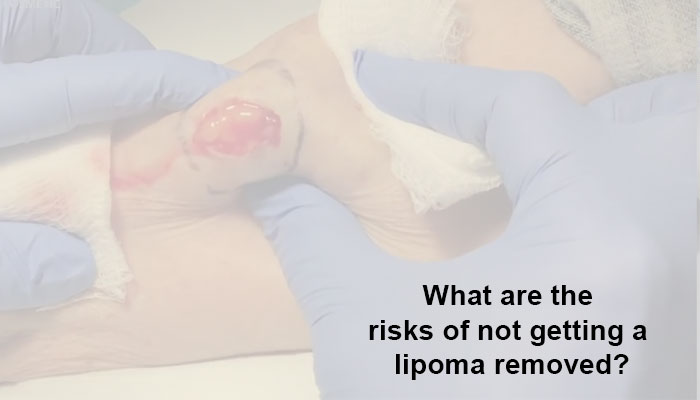

What are the risks of not getting a lipoma removed?

While lipomas are not typically harmful, they can sometimes cause problems if they grow too large. If the lipoma is pressing on tissues or organs, it can cause pain or discomfort. In some cases, lipomas can also become infected.

If you are experiencing any symptoms related to your lipoma, it is important to see a doctor. Lipoma removal is not typically a covered procedure by insurance companies, but there are ways that you can get it covered. Request a pre-authorization from your insurance company, and see if your lipoma is considered a cosmetic issue. Get the procedure done at a teaching hospital to reduce the cost. If all else fails, file a claim with your insurance company. Keep in mind that lipoma removal is a safe and relatively simple procedure, so the risks of not getting it removed are minimal.

How to get lipoma removal covered by insurance?

As we mentioned earlier, the lipoma removal procedure is not typically covered by insurance companies. However, there are a few ways that you can get the procedure covered.

– Request a pre-authorization from your insurance company

– See if your lipoma is considered a cosmetic issue

– Get the procedure done at a teaching hospital

– Request a waiver from your insurance company

– File a claim with your insurance carrier

Requesting a pre-authorization from your insurance company is the best way to ensure that the lipoma removal is covered. Typically, insurance companies will only cover a procedure if it is pre-authorized. If your lipoma is considered a cosmetic reason, your insurance company may not cover the procedure. However, this can vary from company to company.

How much does lipoma removal surgery cost?

The cost of lipoma removal surgery can vary depending on the size and location of the lipoma. In general, the procedure will cost between $500 and $3000. If you are having the surgery done at a teaching hospital, the cost will be lower. Requesting a waiver from your insurance company is another option if the lipoma removal is not covered. If all else fails, you can file a claim with your insurance company.

The recovery time after lipoma removal surgery is typically short. Most people are able to return to their normal activities within a few days. However, it is important to follow the doctor’s instructions carefully. You may need to take a few weeks off work if the lipoma is located on a visible part of your body.

Frequently asked questions:

How much does it cost to remove a small lipoma?

The cost of lipoma removal surgery can vary depending on the size and location of the lipoma. In general, the procedure will cost between $500 and $3000.

How long does it take to recover from surgery?

Most people are able to return to their normal activities within a few days. However, it is important to follow the doctor’s instructions carefully. You may need to take a few weeks off work if the lipoma is located on a visible part of your body.

Most people are able to return to their normal activities within a few days. However, it is important to follow the doctor’s instructions carefully. You may need to take a few weeks off work if the lipoma is located on a visible part of your body.

Is the surgery painful?

The surgery is not typically painful. You will be given anesthesia to ensure that you do not feel any pain.

Is lipoma removal expensive?

The cost of lipoma removal surgery can vary depending on the size and location of the lipoma. In general, the procedure will cost between $500 and $3000. If you are having the surgery done at a teaching hospital, the cost will be lower. Requesting a waiver from your insurance company is another option if the lipoma removal is not covered.

Do dermatologists remove lipomas in the office?

Dermatologists can remove lipomas in the office, but it is typically not a covered procedure. The cost of the surgery will vary depending on the size and location of the lipoma. Requesting a waiver from your insurance company is another option if the surgery is not covered. If all else fails, you can file a claim with your insurance company.

If you are experiencing any symptoms related to your lipoma, it is important to see a doctor (maybe a plastic surgeon). Lipoma removal is not typically a covered procedure by insurance companies, but there are ways that you can get it covered.

How can I get rid of lipomas without surgery?

There is no cure for lipomas, but they can often be removed without surgery. If you are experiencing any symptoms related to your lipoma, it is important to see a doctor. Lipoma removal is not typically a covered procedure by insurance companies, but there are ways that you can get it covered.

Conclusion:

Lipomas are fatty tumors or fatty lumps that can be removed through surgery. If you’re considering having a lipoma removed, it’s important to understand whether or not the procedure will be covered by your insurance policy. In most cases, lipoma removal is considered a cosmetic procedure and will not be covered by insurance. However, there may be certain exceptions depending on your individual policy. We hope this article has been helpful in explaining the basics of lipoma removal, is lipoma removal covered by insurance, and how to get it covered by insurance.